Policy brief: Customs duties on electronic transmissions – why the WTO moratorium matters

Today, countries are prohibited from imposing tariffs on electronic transmissions. If the countries attending the WTO Ministerial Meeting in Abu Dhabi do not agree to extend the moratorium, we are facing a very uncertain digital trade environment with potential tariffs and customs procedures on electronic transmissions. There is uncertainty about the actual consequences of lifting the moratorium, given that questions remain about its scope and definition. Music, film, publications and even computer software might be within the scope.

To illustrate what a potential world without the moratorium would look like, the following hypothetical scenarios may help clarify some of the potential implications.

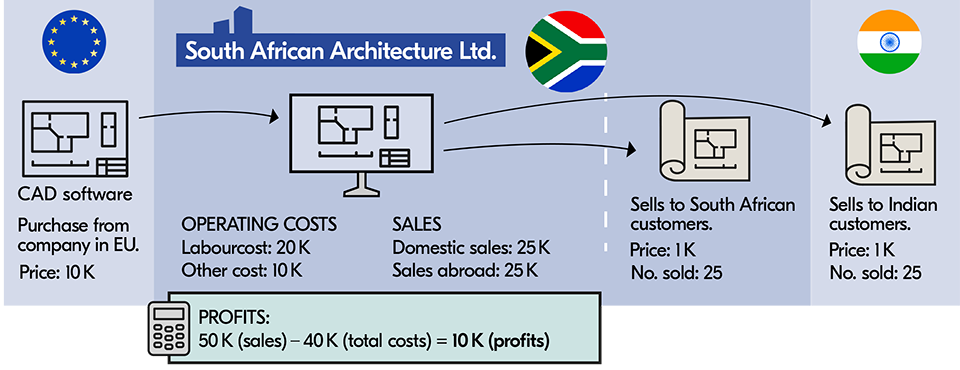

Scenario 1. The world today WITH a moratorium

A business in South Africa sells digital architectural drawings both domestically and to customers in India. In their designs process they need to use a Computer-Aided-Design (CAD) software which is sold by a European firm and downloaded from the internet.

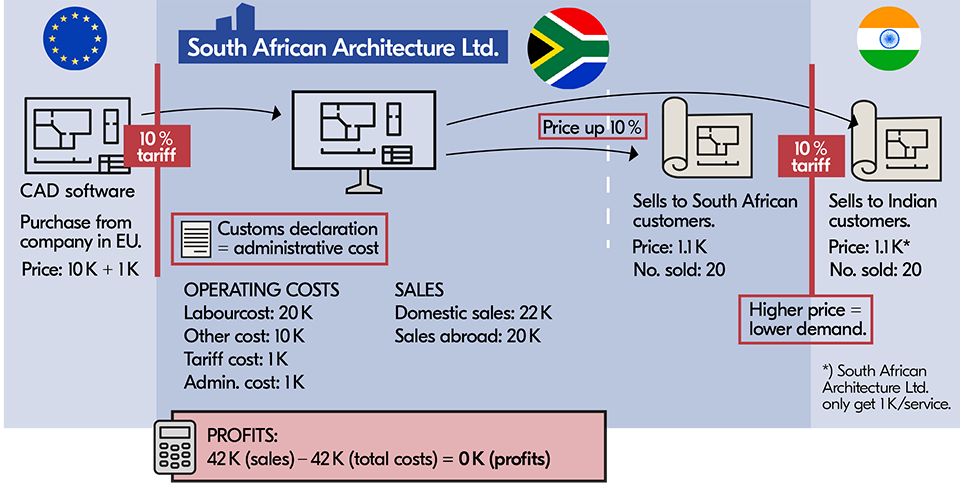

Let’s assume that South Africa, Indonesia and India (countries most vocal on the moratorium) start applying a uniform 10 per cent customs duty on electronic transmissions which also comes with the obligation to submit customs declarations.

Scenario 2. WITHOUT a moratorium

Tariffs are now applied to these types of digital inputs, raising the price of the software for the company. This could potentially also entail an administrative procedure that requires the company to fill out a customs declaration. The company pushes the increased costs on to their consumers and prices rise. This lowers the demand for their products, and they sell less both in South Africa and India.

Net impact on the economy

- The introduction of the Moratorium has turned a small company from being profitable to being non-profitable.

- Government is now collecting 1 K of revenue

- The South African Business has lost 10 K of revenue and is now on break-even.

- Domestic prices have also risen as companies are shielded from foreign competition so consumers will pay more for the same products.

- Foreign companies which do not tax digital inputs will have a cost advantage compared to the South African Business and be more competitive internationally.

Effects on trade

To estimate the potential effect of lifting the moratorium there needs to be common understanding what it entails.

There is no agreed definition of electronic transmission, but it is often defined as the online delivery of products that can be digitised. However, in practice deciding whether something is an electronic transmission or a service is very hard. This is important in a moratorium context since, according to WTO law, countries are allowed to collect tariffs on goods but not on services.

Music, film, publications, computer software, app updates, and software security patches could potentially be within the scope of a “electronic transmission”. But if they are a part of a subscription service, they will probably be seen as a service. With new technologies such as 3D printing the scope could also widen.

If the moratorium is not extended, it is also likely that countries would choose different definitions of what constitutes an electronic transmission, creating a fragmented and uncertain business environment.

Customs procedures for electronic transmission in Indonesia

Thus far, Indonesia is the only WTO member that has introduced customs procedures for intangible products. Indonesian importers must self-declare the value of a digital product and where the producer is located. Indonesia has for example chosen to exclude subscription-based purchases, which demonstrates the difficulty of classifying goods and services in a digital context.

Even though the case of Indonesia gives some indication of what a customs procedure for electronic transmission could look like, many questions remain. It is still unclear whether it is only companies that need to fill in customs declarations or whether end-consumers should be regarded as importers if, for example, they download a software for their own use. It is also not clear whether, a laptop that is imported along with an item of software, and the software is upgraded as part of the after-sales service, should also be subject to customs procedures.

The cost of imposing tariffs

Several studies have examined both the fiscal implications and the broader effects on the economy if this were to be implemented. Existing studies show that the moratorium has had a relatively small impact on fiscal revenues. Studies have also shown that VAT is arguably also a preferred instrument compared to tariffs as it excludes intermediate inputs and is less trade distortive.

There are clear direct and indirect costs of imposing tariffs on electronic transmissions. For companies importing digital goods such as e-books or films, there will be a direct cost and increased administrative burden, which they will likely pass on to domestic consumers. The indirect costs of the tariffs would be significant since software and data analytics are often intermediate input, used by almost all companies, and are crucial to increase efficiency and boost productivity. Studies have shown that using digital inputs can significantly increase the quality of exports. Hence, allowing companies to have access to cheap digital inputs is important for the competitiveness of the economy. Keeping the moratorium in place fosters a sense of certainty and predictability for both domestic digital economic activity, global production networks and supply chains.

References

OECD (2023). Understanding the potential scope, definition and impact of the WTO e-commerce Moratorium. Working Party of the Trade Committee.

WTO (2022). Communication from Indonesia. WT/GC/W/859.

Zhang, H., Liu, Q., Wie, Y. (2023). Digital product imports and export product quality: Firm-level evidence from China. China Economic Review, vol 79, June 2023.

Zhang,Q., Duan, Y. (2023). How Digitalization Shapes Export Product Quality: Evidence from China. Xian Jaotong University

IMF (2023). Why Digital Trade Should Remain Open. Accessed: Why Digital Trade Should Remain Open